Personal Finance: Defined, Importances, Guide & Example

Understanding personal finance is a prerequisite for achieving financial security, building wealth, and attaining your life goals. This article explores the key aspects of personal finance, including its importance, the five basic areas of finance, effective strategies, and practical examples. This guide will equip you with the knowledge and tools to make informed financial decisions and secure a prosperous future.

What Is Personal Finance?

Personal finance is the process of managing your financial activities and decisions to achieve personal goals, create financial security, and improve overall well-being. It encompasses a comprehensive understanding of how to handle income, control expenses, save for the future, and invest wisely.

At its core, personal finance is about creating a plan for your money that aligns with your short-term needs and long-term aspirations. The plans you should make include saving for an emergency fund to planning for retirement, buying a home, funding education, or even achieving financial independence.

The Importance of Personal Finance

Personal finance is more than just managing money; it’s a tool for achieving stability, reducing stress, and creating opportunities. Prioritizing personal finance is an investment in both your present and future well-being.

Achieving Financial Stability

Personal finance makes the framework for managing your income, expenses, and savings effectively. Following a budget means your needs are met and you are prepared for unexpected situations, such as emergencies or job loss. Financial stability supports you in living comfortably without constant stress about money.

Planning and Reaching Goals

If you’re saving for a home, funding education, or planning a dream vacation, personal finance will help you allocate resources toward achieving these goals. A well-crafted financial plan aligns your spending and saving habits with your aspirations, making it easier to turn dreams into reality.

Reducing Financial Stress

Money-related issues are a major source of stress for many people. So, when you gain control over your finances and have a clear plan, you can reduce anxiety. Financial security allows you to focus on other aspects of life, like relationships and personal growth, with peace of mind.

Building Wealth Over Time

Sound personal finance practices are regular saving and wise investing. They also help grow your wealth. Moreover, understanding concepts like compound interest and investment diversification holds your money works for you over the long term.

Making Informed Financial Decisions

Based on effective personal finance, you can make better decisions when it comes to spending, borrowing, and investing. Financial literacy reduces the likelihood of making costly mistakes, such as overspending or taking on unnecessary debt.

Preparing for Life’s Major Events

Life events such as marriage, having children, buying a home, or retiring often have significant financial implications. Personal finance aids you in planning for these transitions, resulting in you being financially prepared and able to handle the changes with confidence.

Gaining Financial Independence

Being in control of your finances fosters independence and self-reliance. Personal finance skills benefit you are less dependent on others and better equipped to manage your own financial future. This sense of empowerment can significantly improve your quality of life.

Creating a Legacy

Effective personal finance management will plan for the next generation. What you should do is build generational wealth through investments, savings, and estate planning with the purpose provide financial security for your family and leave a meaningful legacy.

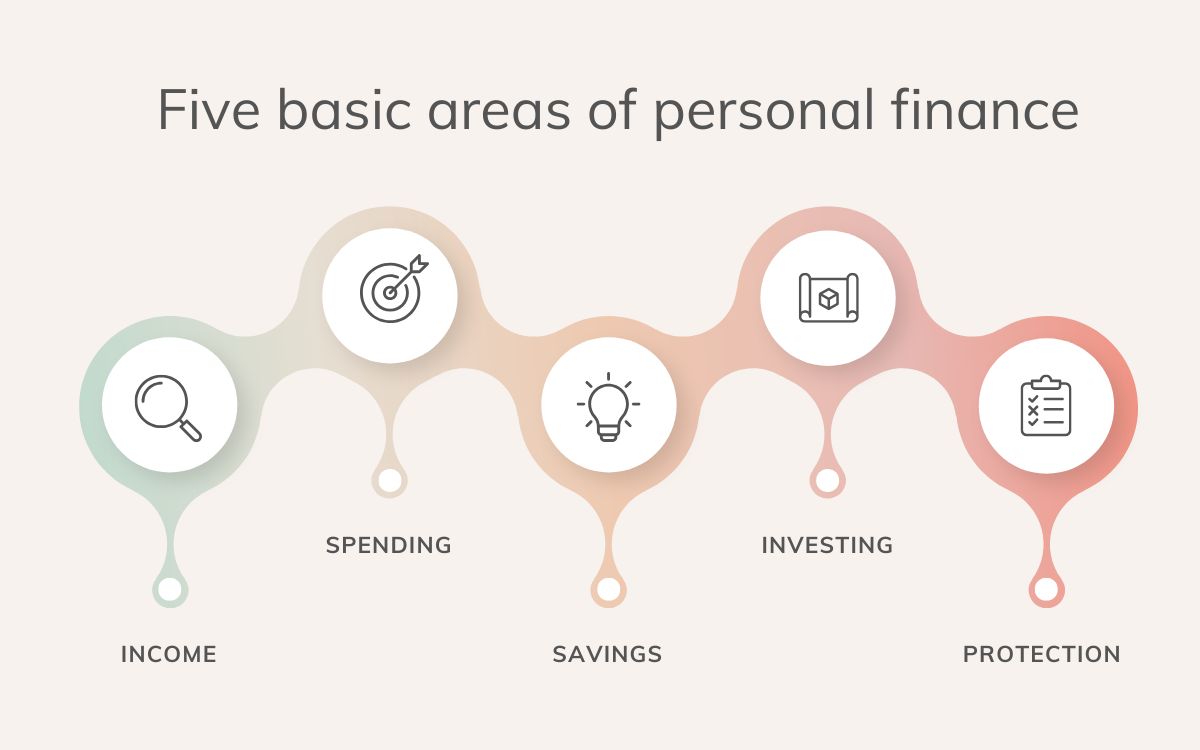

What are the five basic areas of personal finance?

The five basic areas of personal finance are income, spending, savings, investing, and protection.

Income

Income is the foundation for managing all other financial areas. It is the primary source of funds that enables individuals to meet their daily expenses, save for the future, and invest to grow wealth. Without a steady income, it becomes challenging to achieve financial goals or maintain a stable financial life.

Income directly determines an individual's financial capacity. The amount with consistency of income dictates how much a person can allocate to spending, saving, investing, and protection. For instance, a higher income may provide more opportunities to save for emergencies, invest in assets, or purchase comprehensive insurance plans. A limited income might necessitate stricter budgeting and prioritization.

To manage income effectively, you need to understand your earnings, create a budget, and find ways to improve cash flow, such as seeking a raise, starting a side hustle, or exploring passive income opportunities.

Spending

Spending represents how income is used to meet daily needs, fulfill obligations, and achieve personal goals. Managing spending effectively ensures financial stability and prevents debt accumulation.

Spending can be divided into two primary types: fixed expenses and variable expenses. Fixed expenses, like rent, loan payments, insurance premiums, are predictable and recurring, making them easier to budget for. Variable expenses, such as groceries, entertainment, utility bills, fluctuate and often require closer monitoring to prevent overspending.

Good spending habits are essential for maintaining a balanced financial life. You should adhere to a budget, track expenses, and prioritize needs over wants. Overspending or failing to control discretionary expenses can lead to financial stress. Opposite, mindful spending can free up resources for saving and investing.

Savings

Savings set aside a portion of income for future needs, emergencies, and financial goals. It is a buffer against unexpected expenses and provides the foundation for achieving both short-term and long-term financial stability.

One key purpose of savings is to build an emergency fund, which typically covers 3–6 months of essential living expenses. This fund safeguards against financial disruptions caused by job loss, medical emergencies, or unexpected repairs. Without such savings, individuals may be forced to rely on credit, leading to debt accumulation.

Savings also meet planned expenses, such as vacations, home improvements, or large purchases, without incurring debt. Additionally, setting aside money regularly contributes to financial independence by enabling investments and long-term wealth accumulation.

Effective saving strategies include automating savings, setting clear financial goals, and reducing unnecessary expenses.

Investing

Investing growing wealth over time by allocating money to assets that can generate returns. It is essential for achieving long-term financial goals, such as retirement, education funding, or wealth accumulation. Unlike saving, which prioritizes safety and liquidity, investing involves risk in exchange for the potential of higher returns.

There are various types of investments, including stocks, bonds, mutual funds, real estate, and retirement accounts like 401(k)s or IRAs. Each investment vehicle carries different levels of risk and return. Individuals can create a diversified portfolio that aligns with their financial goals, risk tolerance, and time horizon. For example, younger investors with a long-term focus may opt for higher-risk assets like equities, while those nearing retirement may prioritize stability through bonds or dividend-paying stocks.

Investing also benefits from the power of compound interest, where earnings generate additional returns over time. No doubt that starting early is a key advantage for building wealth. However, you need to have effective investing knowledge, careful planning, and periodic review to adjust strategies based on market conditions or changing financial objectives.

Protection

Protection safeguards individuals and families from financial risks and uncertainties. Having steady protection, unexpected events, such as accidents, illnesses, or natural disasters, do not jeopardize financial stability or long-term goals. Protection provides peace of mind and a safety net during challenging times.

The cornerstone of financial protection is insurance, which comes in various forms, including health, life, disability, auto, and homeowners insurance. Each type addresses specific risks, such as medical expenses, income loss, or property damage, and helps prevent financial ruin in case of an emergency. For instance, life insurance makes sure that dependents are financially secure after the policyholder's death. Health insurance minimizes the financial burden of medical treatments.

Protection also includes estate planning, such as drafting wills, setting up trusts, and designating beneficiaries. Assets are distributed according to one's wishes. Dependents are cared for in the event of incapacitation or death.

How to create Personal Finance Strategies?

Personal finance strategies help individuals create a clear plan, stay disciplined, and make informed decisions. Here are several key strategies to consider:

Budgeting Strategies for Personal Finance

Budgeting provides a structured plan to manage income and expenses effectively. It starts with understanding your income sources, which may include salaries, freelance earnings, rental income, or dividends. For those with fluctuating income, it is essential to use conservative estimates based on past trends to avoid overestimating available funds. Knowing your income lays the foundation for a successful budget.

The next critical step is tracking your expenses. You should record every expense, whether fixed or variable to clearly understand where your money is going. Fixed expenses include rent, utilities, and loan payments. Variable expenses may cover groceries, dining out, or entertainment. Additionally, discretionary spending on non-essential items, such as luxury goods or subscriptions, should be monitored. Analyzing spending patterns can help identify areas of overspending and opportunities to save.

You can use various budgeting methods, such as the 50/30/20 rule, which allocates 50% of income for needs, 30% for wants, and 20% for savings or debt repayment. Alternatively, a zero-based budget assigns every dollar a purpose so that income matches expenses exactly. Whichever method is chosen, it is crucial to incorporate savings as a fixed expense and automate transfers to savings or investment accounts to build financial security.

Debt Management for Personal Finance

Effective debt management minimizes the negative impact of debt on overall finances, reduces financial stress, and supports long-term wealth building.

Understanding Your Debt

Gaining a comprehensive understanding of your debt portfolio by listing all debts - credit card balances, personal loans, mortgages, student loans, and any other liabilities. For each debt, note the outstanding balance, interest rate, minimum payment, and due date. This clarity instructs us to prioritize debt and formulate a repayment plan.

Creating a Debt Repayment Plan

Once your debts are identified, create a structured repayment plan. Two popular methods are the debt snowball and debt avalanche approaches:

Debt Snowball Method: Paying off the smallest debt first while making minimum payments on others. This method builds psychological motivation as you experience quick wins.

Debt Avalanche Method: Prioritize debts with the highest interest rates first, as this approach minimizes the overall cost of borrowing in the long term. Choose the method that aligns with your financial goals and psychological preferences.

Consolidating and Refinancing Debt

For individuals with multiple high-interest debts, debt consolidation can simplify repayment and potentially lower interest rates. They should combine multiple debts into a single loan with a lower interest rate or more favorable terms. Refinancing, particularly for mortgages or student loans, can also reduce interest rates, shorten repayment periods, or lower monthly payments.

Avoiding New Debt

Preventing the accumulation of new debt requires disciplined spending and a clear understanding of needs versus wants. Limit the use of credit cards, especially for discretionary purchases, and avoid taking on new loans unless absolutely necessary. Building an emergency fund can also help cover unexpected expenses without resorting to debt.

Negotiating with Creditors

If debt becomes overwhelming, consider negotiating with creditors for more favorable terms - requesting lower interest rates or extending repayment periods. Many creditors are willing to work with borrowers to find mutually beneficial solutions.

Saving and Emergency Fund

Saving and building an emergency fund construct financial security and soothe the stress of unforeseen expenses. Savings achieve both short-term and long-term financial goals, while an emergency fund acts as a safety net during unexpected situations. Together, they play a critical role in financial stability.

Saving is setting aside a portion of income for future use. It is often categorized into short-term, medium-term, and long-term savings, each targeting different goals. Short-term savings might cover immediate needs like vacations or small purchases. Medium-term savings focus on larger goals (a car or home down payment). Long-term savings, often invested, aim to secure significant future milestones, like retirement or children’s education.

An emergency fund, on the other hand, is a dedicated reserve designed to handle unexpected expenses, such as medical bills, car repairs, or temporary income loss.

To avoid common pitfalls, it’s important not to underfund the emergency fund or misuse it for non-urgent expenses. You should replenish the emergency fund promptly after use to remain available when needed. Balancing emergency fund contributions with other savings goals prevents neglect of either priority and promotes overall financial well-being.

Investing for the Future

Investing for the future is an indispensable factor in growing their wealth, achieving long-term financial goals, and creating financial independence. Investing aims to generate returns over time, leveraging the power of compounding and market growth. It is a proactive way to make money work for you.

The first step in investing is defining your financial goals. These goals can vary widely - saving for retirement, funding a child’s education, purchasing a home, or building generational wealth. Having clear objectives determines your investment timeline and risk tolerance.

Next, understand your risk tolerance. Risk tolerance is influenced by factors such as age, income stability, and financial obligations. Younger individuals with decades ahead to recover from market downturns might opt for more aggressive investments. Those nearing retirement may prefer conservative portfolios to preserve their wealth.

Diversification is a cornerstone of successful investing. You should spread investments across various asset classes, such as stocks, bonds, mutual funds, and real estate, to reduce risk. Within each asset class, further diversification — like investing in different industries or geographic regions — protects against significant losses if one sector underperforms.

Over time, market fluctuations may cause your asset allocation to drift from its original targets. In times like these, you should rebalance your investments to remain in line with your desired level of risk and return.

To avoid common pitfalls, you have to get used to resisting impulsive decisions driven by market emotions, such as panic selling during downturns or chasing trends during rallies. Staying disciplined and adhering to a well-defined investment strategy maintains long-term goals.

Insurance and Protection

Insurance and protection build a safety net that shields individuals and families from financial hardships caused by unexpected events. Insurance preserves wealth so that unforeseen circumstances do not derail long-term financial goals.

The first step is understanding the different types of coverage available and their purposes. Common forms of insurance are health, life, auto, homeowner’s or renter’s, disability, and liability insurance. Each type addresses specific risks, from medical emergencies and property damage to income loss or legal obligations. Identifying which types of coverage depend on an individual’s circumstances, such as family structure, employment, assets, and lifestyle.

When life circumstances change — such as getting married, having children, buying a home, or retiring — insurance policies should be reviewed and updated to make they align with current priorities. Over-insuring or under-insuring can both be detrimental, so striking the right balance is key.

Additionally, understanding policy terms and comparing providers is an essential element to maximizing the value of insurance. Factors like premiums, deductibles, coverage limits, and exclusions should be carefully assessed to choose policies that offer adequate protection at an affordable cost. To make an informed decision, work with a reputable insurance agent or financial advisor. They can help you navigate complex options and tailor coverage to individual needs.

Tax Planning

Tax planning minimizes tax liability while maximizing savings and investment opportunities.

Understanding Your Tax Obligations

You must know your income tax bracket, applicable tax rates, and how various sources of income — such as wages, investments, rental income, or self-employment earnings — are taxed. For example, earned income is typically taxed at higher rates than capital gains, making it essential to differentiate between various income streams and their tax implications.

Utilizing Tax-Advantaged Accounts

Tax-advantaged accounts lessen taxable income and saving for the future. For education savings, accounts like 529 plans offer tax-free growth and withdrawals when used for qualified expenses. Health Savings Accounts (HSAs), available to those with high-deductible health plans, provide triple tax benefits: tax-deductible contributions, tax-free growth, and tax-free withdrawals for medical expenses.

Claiming Deductions and Credits

Deductions lower taxable income. Credits directly decrease the amount of tax owed. Common deductions include those for mortgage interest, student loan interest, and charitable contributions.

Tax credits, such as the Earned Income Tax Credit (EITC), Child Tax Credit, or education credits like the American Opportunity Tax Credit, can provide substantial savings. Identifying and claiming all eligible deductions and credits is a vital aspect of tax planning.

Estate and Gift Tax Planning

For those with substantial assets, estate and gift tax planning is an important step in preserving wealth for future generations. Strategies such as gifting assets below the annual gift tax exclusion, establishing trusts, or utilizing charitable giving programs can minimize estate taxes while fulfilling philanthropic goals.

Common Mistakes to Avoid

Common mistakes to avoid are underestimating tax liabilities, failing to claim eligible deductions or credits, and neglecting to adjust withholding or estimated tax payments. Additionally, over-contributing to tax-advantaged accounts or mismanaging investment sales can result in unexpected tax consequences.

Financial Goal Setting

Financial goal setting includes steps defining specific, measurable, and actionable objectives to create a framework that guides financial decisions and actions. This process encourages discipline, fosters focus, and individuals can align their financial choices with their life priorities.

Without clear goals, it is easy to become distracted, overspend, or miss valuable opportunities. Defined objectives act as a motivator, driving individuals to make better financial decisions and remain committed to their plans.

Financial goals can be divided into three broad categories based on time horizon. Short-term goals are those that can be achieved within a year, such as building an emergency fund, paying off small debts, or saving for a vacation. Medium-term goals typically span 1 to 5 years, like saving for a home down payment, buying a car, or funding further education. Long-term goals, on the other hand, take 5 or more years to achieve and include major milestones like retirement savings, paying off a mortgage, or establishing a college fund for children.

To create clear financial goals, it is essential to use the SMART framework. SMART goals are specific, measurable, achievable, relevant, and time-bound. For example, instead of simply saying "save for retirement," a SMART goal would be "Contribute $500 monthly to a 401(k) to reach $1 million by age 65."

Not all goals are of equal importance or urgency, and understanding which goals take precedence can help direct resources more efficiently. For instance, high-priority goals like building an emergency savings fund, paying off high-interest debt, and securing necessary insurance coverage should be addressed first. Medium-priority goals, such as saving for a down payment on a house or contributing to a child’s education fund, come next. Lower-priority goals might include discretionary spending on vacations or luxury items.

However, there are common pitfalls that people should avoid when setting financial goals. Setting unrealistic goals that are too ambitious can lead to frustration and disappointment. Neglecting smaller goals while focusing solely on long-term aspirations can create financial strain. It’s also important to be adaptable; life circumstances change, and goals may need to be reassessed and adjusted periodically. Finally, failing to track progress can lead to missed milestones and make it difficult to stay on course.

Estate Planning

Estate planning prepares for the efficient management and distribution of assets after an individual’s death or incapacitation. It results in your financial legacy being passed on according to your wishes while minimizing potential conflicts and financial burdens for your loved ones.

One of the foundational elements of estate planning is creating a will. A will specify how your assets will be distributed, name the beneficiaries, and appoint guardians for minor children. Without a will, the distribution of your assets may be determined by state laws.

Establishing trusts is often used to manage assets for specific purposes. Trusts can offer for the education of children, support long-term care needs, or even reduce tax liabilities. They can also protect your assets and seamlessly transfer them to beneficiaries without the need for probate.

Personal Finance Example

Here’s an example of personal finance to illustrate how managing finances effectively can lead to financial stability and goal achievement:

Scenario: Building a Financially Secure Future

Sarah is a 30-year-old marketing professional who earns $60,000 annually. She decides to take control of her finances to achieve her short-term and long-term goals, such as buying a home, saving for retirement, and building an emergency fund.

Budgeting: Sarah creates a monthly budget by tracking her income and expenses. She allocates 50% of her income to needs (rent, utilities, groceries), 30% to wants (dining out, entertainment), and 20% to savings and debt repayment using the 50/30/20 rule.

Emergency Fund: Sarah begins saving three months’ worth of expenses in a high-yield savings account to cover unexpected events like medical bills or job loss. She sets aside $500 monthly, reaching her goal of $9,000 in 18 months.

Debt Management: Sarah has $5,000 in credit card debt at a 20% interest rate. She prioritizes paying it off using the avalanche method, prioritizes high-interest debt while making minimum payments on others.

Investing for Retirement: Sarah enrolls in her employer’s 401(k) plan, contributing 10% of her salary and taking advantage of the company’s 5% match. She invests in a diversified mix of index funds to make steady growth over time.

Saving for a Home: Sarah sets a goal to save $20,000 for a down payment on a house within five years. She opens a separate savings account and contributes $333 monthly to reach her target.

Insurance and Protection: To safeguard her finances, Sarah purchases health, auto, and renters insurance. She also gets life insurance to provide for her family in case of an emergency.

Financial Literacy: Sarah reads personal finance blogs, listens to podcasts, and consults a financial advisor to stay informed about managing money and exploring new investment opportunities.

Some financial courses that we would like to introduce to you, hope they are useful for your learning path. Please click on the course name below to learn more:

Personal Finance For Beginners | Financial Planning 101

The Personal Finance For Beginners | Financial Planning 101 course is designed to empower individuals with the essential knowledge and skills needed to effectively manage their personal finances. In today's complex financial landscape, it is crucial to have a solid foundation in financial planning to achieve financial stability and reach long-term goals.

This course serves as an introductory guide, providing comprehensive insights into the key concepts and strategies of personal finance. Students will learn wealth building strategies, credit repair tactics, and funding secrets. Additionally, they will explore the importance of saving, investing, and managing money wisely.

The Fundamentals Of Finance For Non-Finance Professionals

Have you ever been in a position where you’re talking about your P&L, and had nagging doubts about what you were talking about? Have you ever used terms like EBIT or NPV without really understanding what they are or what they mean? Do you see mysterious financial transactions happening that affect your results, but you don’t know how (or if) you can affect them? If any of these are true, this course will remove those doubts and raise your understanding. You’ll be smarter, sound smarter, and be able to make better, faster decisions as a result.

Secret Tax Saving Ideas Your Advisors AREN'T Showing You!

In the first part of this course you’ll learn that we have actually been here before in America, and that we used HIGHER TAXES to work our way back to normalcy.

In the rest of the course, lecturer’ll explain what you can do over the next several years to PREPARE and AVOID the higher taxes others will have to pay. It’ll be like having a CRYSTAL BALL when the course ends!

Conclusion

Personal finance lays the foundation for financial well-being and personal growth. Developing personal finance strategies tailored to your goals and circumstances supports you’re prepared to navigate life’s financial challenges confidently.

A well-managed financial life leads to greater peace of mind and the freedom to pursue what matters most. But how to get good financial management skills? Let's refer to Skilltrans courses.

Meet Hoang Duyen, an experienced SEO Specialist with a proven track record in driving organic growth and boosting online visibility. She has honed her skills in keyword research, on-page optimization, and technical SEO. Her expertise lies in crafting data-driven strategies that not only improve search engine rankings but also deliver tangible results for businesses.